Chande Momentum Oscillator on Forex

What is Chande Momentum Oscillator (CMO)?

Strong trends are rare in the financial markets, and sometimes it would take too much time for a trader to wait for a strongly one-sided price action. In most cases, assets continue to move in tight sideways ranges and bounce up and down several times during trading. Such a price action allows traders to make profits from both sides of the market, doubling potential bargain prices. This is especially true for cross rates such as EUR/GBP or AUD/CAD. The nature of these waves comes from cyclical trading, as speculators and real money accounts buy a currency during their trading hours and then other countries intervene and sell the same currency. To benefit from a two-way price action, the trading system must be equipped with a well thought-out combination of technical indicators that show oversold and overbought values on intraday charts.

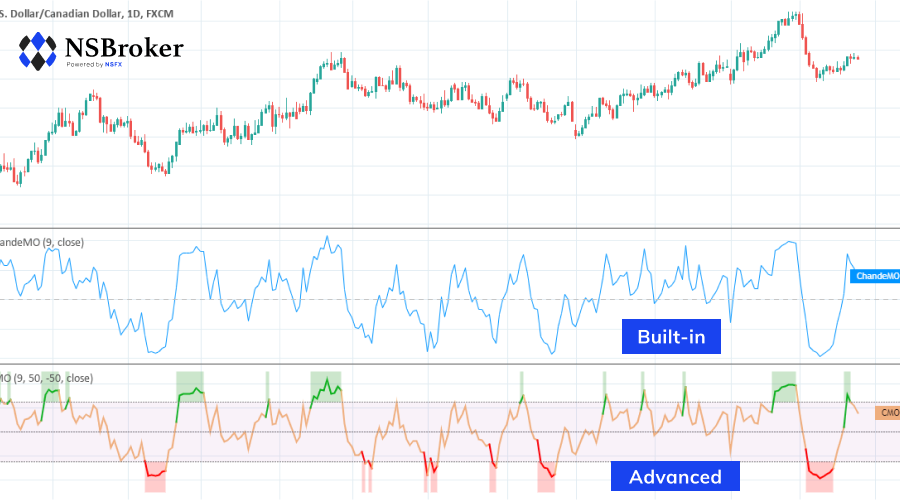

Tushar Chande, a technical analyst, developed his own oscillator to show the dynamics of the market. Although it is similar to popular indicators such as the Relative Strength Index and Stochastic Oscillator and is also limited in its range (from -100 to +100), the Chande Momentum Oscillator (CMO) provides reliable trading signals that show the strength of bulls or bears in current market conditions. The mathematical formula takes into account the sum of all recent gains and losses and divides it by the total value of all price actions for the given period. We prefer CMOs with a standard period of 9 bars, while traders could test the strategy with different periods.

The secondary instrument of the trading system is the standard Relative Strength Index oscillator, which indicates oversold and overbought stocks and market dynamics. The main purpose of RSI is to confirm or reject signals from the CMO, while additional features of RSI help to find reverse divergences on the chart. The period should be modified. We recommend using the 13-bar period for quick and frequent entries and exits (scalping strategy with tight stop-loss and take-profit orders), while swing traders who want to buy and hold an asset should extend the period to 21 bars. The trading system is suitable for all investments with a time frame of more than 15 minutes. However, we would like to remind traders to check market conditions before using the system as it works best in areas without a strong trend.

How To Use CMO?

When it comes to entering conditions, they are quite simple. The most important requirement before opening Longs is to check the peaks of both oscillators. The Chande Momentum oscillator must be below the -50 level and have more room to go up, while the RSI must be above the 30 level, as this is the threshold for "oversold" conditions. Short trades should be considered when the CMO is above +50 while the RSI is below 70. Therefore, we find that the top and bottom of the current price, and additional instruments such as horizontal static resistance/support line could help filter market noise and prevent false signals.

The exit conditions and time in the market depend on the chosen investment and time frame. As we show in an example of the system in action on the EUR/GBP chart, which is one of the most liquid cross rates in the forex market, the recommendations for profit taking are as follows: 15-20 pips for 15-minute chart, 20-25 pips for 30-minute chart, 30 pips for 1 hour, and so on. Stop-loss orders should be calculated according to the rules of risk management, and the ratio of profit to risk should not be less than 2:1.